From the Elder Abuse Prevention Ontario:

Elder Abuse Prevention Ontario (EAPO) is the provincial organization recognized for its leadership in elder abuse prevention in the province, providing education, training, resource development and information about the increasingly complex issues of elder abuse.

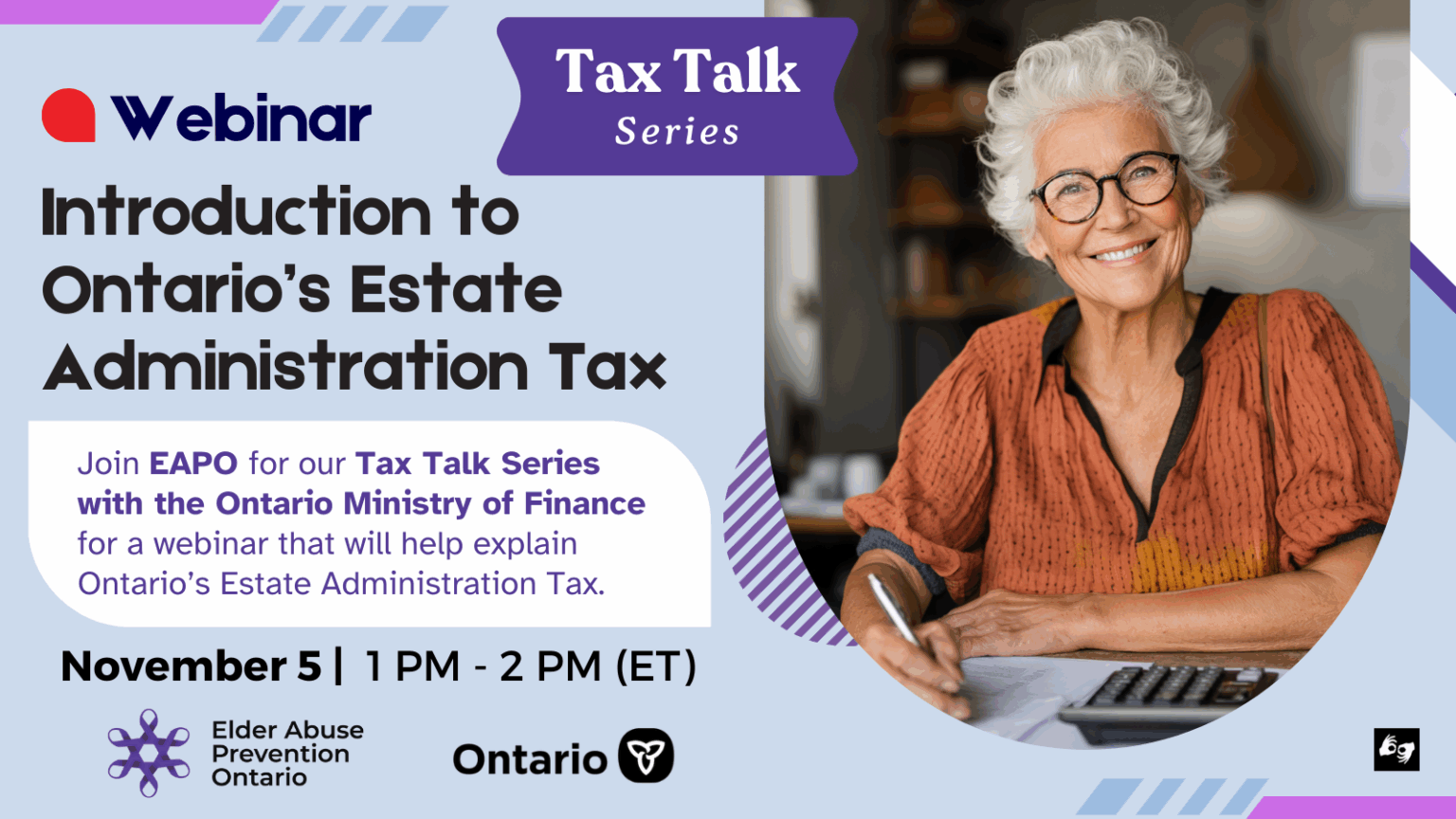

Join EAPO for our Tax Talk Series with the Ontario Ministry of Finance for a webinar that will help explain Ontario’s Estate Administration Tax and how it could apply to your estate or an estate you are administering, “Introduction to Ontario’s Estate Administration Tax” on Thursday, November 5th from 1-2pm EST. Webinar is provided with ASL interpretation. Register today!

By the end of this webinar, participants will be able to:

- What Estate Administration Tax is when it is payable on the value of an estate

- What assets to include and exclude when calculating the value of an estate for tax purposes

- How to calculate and pay the tax

- How to file an Estate Information Return

In addition, you will have the opportunity to get answers to general questions you may have about Ontario’s Estate Administration Tax.

SPEAKERS:

Stephanie Holdam is a Senior Program Advisory Specialist at the Ontario Ministry of Finance. With over 12 years in public service, she brings to her role a deep passion for public engagement and a wealth of expertise in Ontario’s tax laws and programs. Stephanie specializes in Estate Administration Tax, providing clear and informed guidance to help Ontarians fulfill their obligations during significant life transitions.

Leon Barnes is a Program Advisory Specialist at the Ontario Ministry of Finance, with expertise in multiple tax laws including Employer Health Tax and Land Transfer Tax. Known for his contagious optimism, Leon brings clarity and enthusiasm to his work, helping clients and colleagues alike better understand Ontario’s tax system.

Comments are closed